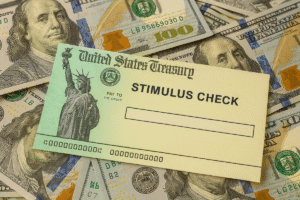

In July 2025, the government has launched a new round of relief funds, offering up to $2,800 to help struggling households deal with inflation, rent hikes, and utility bills. This support package focuses on low- and middle-income earners, especially families affected by job losses, reduced hours, or increased living expenses. The relief is meant to bridge the financial gap for those still recovering from economic uncertainty and to ensure essential needs are met without added debt.

Who Can Qualify for the Payment?

Eligibility for the $2,800 relief is based on household income, size, and prior benefit status. Individuals earning less than $75,000 annually or couples earning below $150,000 qualify for the full amount. Those who claimed dependents in their latest tax filing may receive additional funds. Recipients of previous stimulus checks, food assistance, or unemployment benefits are automatically reviewed for this round, while new applicants must submit income and residency documentation.

How and When Will Payments Be Made?

Payments will be distributed starting mid-July 2025 through direct deposit, mailed checks, or prepaid debit cards. The IRS and state agencies will use the latest tax records to determine eligibility. Those who haven’t filed taxes recently or changed bank details should update their information immediately. Households that qualify but aren’t enrolled in federal aid programs can apply through their state relief portals by July 31 for timely payment.

Breakdown of the Relief Package

The $2,800 relief isn’t a flat rate for everyone—it varies slightly depending on the number of dependents, tax filing status, and prior benefit participation. Below is a quick overview of how the funds are allocated:

July 2025 Relief Payment Chart

| Category | Amount |

|---|---|

| Single Filer (under $75,000) | Up to $1,400 |

| Married Couple (under $150,000) | Up to $2,800 |

| With 1–2 Dependents | Additional $600–800 |

| Payment Method | Direct Deposit / Check / Card |

| Application Deadline | July 31, 2025 |

The July 2025 relief funds bring much-needed assistance to families struggling with rising expenses. With up to $2,800 available, this payment can cover rent, groceries, medical bills, or help you save during uncertain times. Whether you’re a parent, a senior, or recently unemployed, check your eligibility today and don’t miss out. Applications are simple, and payments are already on the way for many—so act fast to secure your share.

FAQ’s:

1. Do I have to apply to receive the $2,800 relief?

If you’ve received prior stimulus checks or filed taxes in 2023–2024, you may be automatically enrolled. Otherwise, apply through your state portal.

2. Can I still qualify if I’m unemployed?

Yes, unemployment status increases your chance of qualifying, especially if you meet the income and residency requirements.

3. What if I didn’t file taxes recently?

You can submit an online non-filer form or file a simple return to ensure your eligibility is reviewed.

4. How do I know when I’ll get paid?

You can track your status through the IRS “Get My Payment” tool or your state’s relief site. Most payments begin mid-July.

5. Will this relief affect my tax return or benefits?

No, this payment is not taxable and does not reduce your eligibility for other federal or state benefits.